Frequently Asked Questions

Frequently Asked Question

Investing in Australian property has become popular with overseas investors and Australian expats looking for strong returns and stability.

Surprisingly, many Australian residents who hold temporary visas or permanent visas don’t even realise they can qualify for a home loan and are missing out on the benefits of the Australian real estate market.

Yes, foreign residents, temporary residents, and short-term visa holders are allowed to buy investment properties and residential real estate in Australia, provided that they’re granted permission to do so by the Foreign Investment Review Board (FIRB).

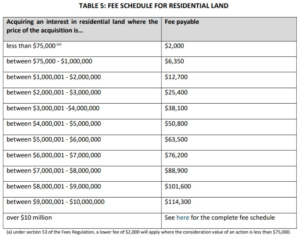

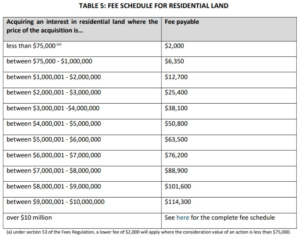

The Foreign Investment Review Board (FIRB) is responsible for ensuring that most foreign property investment is targeted at new dwellings instead of established dwellings. The application process is fairly straightforward. Foreign residents also need to pay a fee when applying to FIRB, and the fee depends on the transaction price. Please refer to the table below:

- Find the right property and pay reservation fee in order to reserve your preferred property. This transaction will ensure your preferred property is taken off the market and no one else can purchase it during the reservation period.

- Sign the Contract of Sale.

- Transfer 10% deposit into Vendor’s solicitor trust account. The balance of the full purchase price will be made upon the completion of property.

- Once the deposit transaction have been made successfully, the reservation fee will be fully refunded at this stage

- We suggest you to prepare your mortgage application about three months prior to settlement date. We can also connect you with some of the reputable banks and financial advisors.

- On the day of settlement you will then make the final payments. Congratulations ! Transaction is completed and you now have the ownership of you property.

- We offer inspection service to all clients as well.

The Australian Stamp Duty rates for most properties typically range between 4% to 5% of your property’s value. This will vary from State to State. In the last few years, the State Governments have imposed additional Stamp Duty of up to 8% for anyone who is a foreign buyer. There is currently no Foreign Buyers Stamp Duty Surcharge in the Northern Territory and the ACT. In NSW and VIC, it’s 8%, and for the rest of the states, it is 7%. For more detail , please consult at your property advisor.

In general, we can refer clients to mortgage broker, which they have more experienced.

Renovation is not necessary because there is a detailed building inspection process. Once the property is completed, floors, carpets, ceilings and lights are all fully installed and no additional renovations are required. The contract will be clearly itemised.

The Australian government is very strict in regulating real estate, and there are laws and regulations to protect the rights and interests of consumers. Chances are extremely rare. Moreover, according to Australian laws, within 7 years after the completion of the property, the builder can be held responsible for any quality problems, and the contractor must make remedies or compensation.

常見問題

投資澳洲房地產已受到海外投資者和尋求強勁回報和穩定的expats歡迎。許多持有臨時簽證或永久簽證的澳洲居民甚至沒有意識到他們有資格獲得住房貸款,並且錯過了澳洲房地產市場的優勢。

是的,外國居民、臨時居民和短期簽證持有人可以在澳洲購買投資物業和住宅房地產,前提是他們獲得外國投資審查委員會的許可 (FIRB)。

海外人士或非居民必須向澳洲 FIRB 申請批准才能購買想要的投資物業。而海外人士向FIRB申請時亦需要繳費,費用視交易的樓價而定。簡單而言,海外買家買入澳洲樓時如樓價等於75,000澳元,申請費為$2,000。詳細FIRB申請費用可參考下圖:

- 家選擇心儀單位後,支付預留費以保留該物業。

- 買家確認並簽署買賣合約,合約成立。

- 合約成立後,支付10%作為首期,首期將保存在律師信託帳戶,等房屋成交時,買家再支付餘款。

- 買家支付首期後,全數退回在簽署合約前所繳交的預留費。

- 如需申請房屋貸款,建議可在房屋成交3–6個月前開始準備相關貸款資料。

- 在成交日,銀行將發放貸款,買家支付餘款,恭喜! 完成交易。

- 為買家代驗收服務。

大多數澳洲房產印花稅稅率通常在房產價值的 4% 到 5% 之間。在過去幾年,州政府對外國買家徵收高達 8% 的額外印花稅。北領地和首都領地目前沒有外國買家額外印花稅。在新南威爾士州和維多利亞州為 8%,而在其他州為 7%。欲知更多詳情,請諮詢您的物業顧問。

一般會介紹Broker中介人給客戶,他們經驗豐富,就連澳洲本土人購買房產也是經這些中介人申請按揭的。

客人無論自住還是投資,收樓的時候都完全不需要裝修。澳洲樓盤收樓時有一個驗樓程序。所有樓盤收樓時,地板、地毯、天花和燈,全部都已安裝妥當,不需要另外裝修。合約會清楚逐項列明。

澳洲政府監管房地產非常嚴謹,有完整的法規保障消費者權益,樓盤出現“爛尾”的機會幾乎是零。而且根據澳洲的法例在該物業落成後7年內,凡有品質問題都可以追究建造商的責任,承建商必須做出補救或賠償。